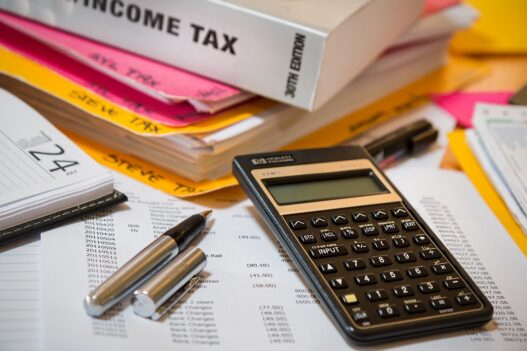

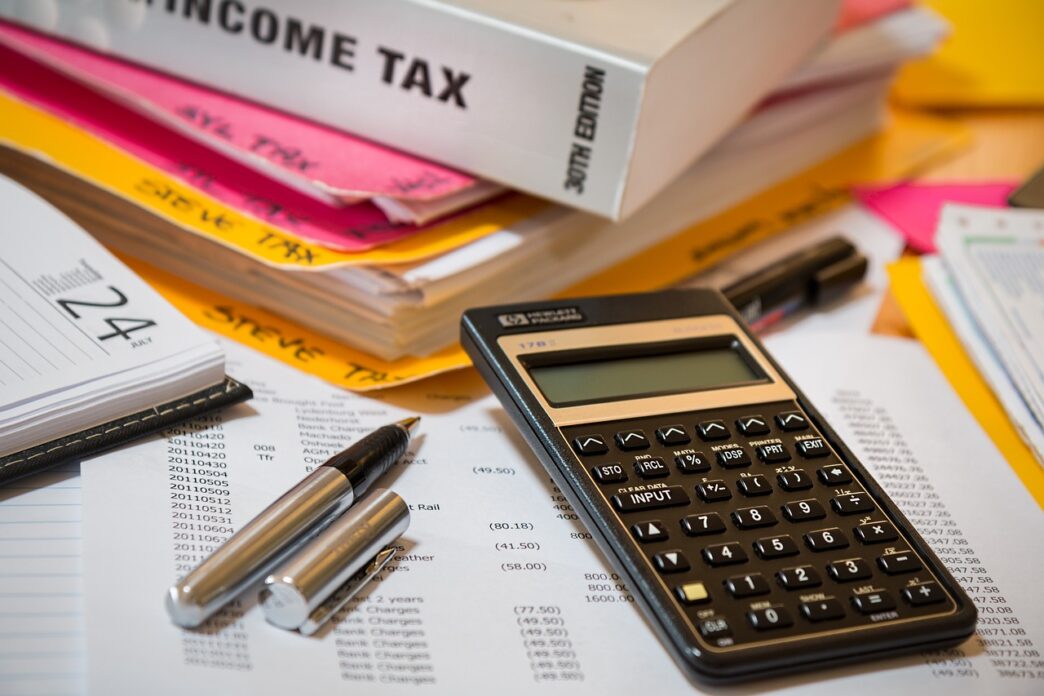

Your financial well-being depends on careful planning and expert guidance. A tax accountant plays a key role in keeping your finances healthy all year. With their help, you can navigate the complexities of taxes, identify potential deductions, and avoid penalties. The Dallas enrolled agent provides expert support, ensuring that your tax returns are accurate and submitted on time. They offer a personalized approach to managing your financial obligations, cutting through confusion and reducing stress.

These professionals not only focus on tax season but also assist with proactive financial strategies throughout the year. By working with a tax accountant, you gain peace of mind knowing your finances are in capable hands. Their expertise helps you make informed decisions, leading to stronger financial stability. You stay prepared for any changes in tax laws and maximize your financial opportunities. This partnership ensures that you enjoy healthier finances, year after year.

Table of Contents

Understanding the Role of a Tax Accountant

A tax accountant helps you in many ways beyond filing taxes. They provide key insights into financial planning, ensuring you comply with tax laws. They analyze your financial status and advise on legal deductions, supporting you to save money. Their role extends to offering sound advice on investments and savings. By understanding tax laws, they guide your financial decisions throughout the year.

Benefits of Year-Round Financial Health

Maintaining financial health year-round offers peace of mind and stability. A tax accountant helps track income, expenses, and deductions monthly. This approach prevents last-minute tax season stress and avoids mistakes. It also allows you to optimize your financial status effectively. Having a financial plan means you are better prepared for unexpected expenses and changes in tax legislation.

Tax Accountant vs. DIY Approaches

Many people wonder about doing taxes themselves using online tools. While these platforms can be helpful, they lack the personalized advice a tax accountant provides. Here’s a comparison:

| Aspect | Tax Accountant | DIY Tools |

|---|---|---|

| Personalized Advice | Yes | No |

| Knowledge of Latest Tax Laws | High | Depends on Tool Updates |

| Audit Support | Yes | Limited |

| Time Investment | Low for You | High |

Preparing for Year-Round Tax Management

Preparation is key to financial health. Begin by organizing your financial documents. Track expenses, income, and any financial changes. Regularly reviewing these documents with your tax accountant helps keep everything in order. Stay informed about any updates to tax laws and how they affect you. This proactive approach can prevent costly mistakes.

Finding the Right Tax Professional

Choosing the right tax accountant is crucial. Look for someone with experience and a strong understanding of current tax laws. Consider recommendations from trusted sources. Ensure they are accredited and reliable. The IRS offers resources for finding qualified tax professionals. Visit the IRS website for more information.

Conclusion

A tax accountant is more than just a tax preparer. They are a partner in managing your finances, helping you stay on top of your financial health throughout the year. They provide expertise and guidance that empower you to make informed financial decisions. With their help, you avoid unnecessary penalties, maximize deductions, and stay compliant with tax laws. Trusting a professional helps secure your financial future with confidence.